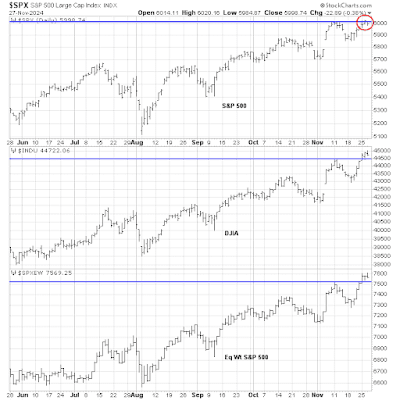

- The S&P 500 and Russell 2000 had to stage upside breakout through the falling dotted trend line. While the S&P 500 briefly broke out, it retreated yesterday through the trend line. The Russell 2000 never came close to a breakout.

- The S&P 500 and Russell 2000 had to break out of their sideways range. Not yet.

- Small caps should outperform, indicating broadening breadth and better participation in an advance. The bad news is the small cap Russell 2000 is lagging. The good news is the equal-weighted S&P 500 is holding up well on a relative basis, and small caps outperformed yesterday during the market decline.

Wednesday, January 8, 2025

A tale of two markets

Sunday, January 5, 2025

A failed Santa rally, now what?

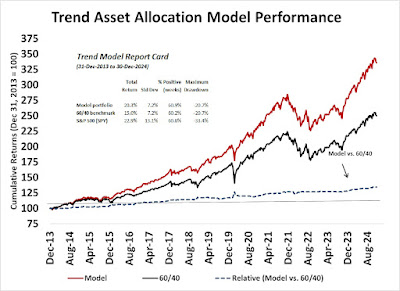

The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)*

- Trend Model signal: Neutral (Last changed from “bullish” on 15-Nov-2024)*

- Trading model: Bullish (Last changed from “neutral” on 19-Dec-2024)*

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent and on BlueSky at @humblestudent.bsky.social. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

Santa has left for the year…

As I pointed out last week, the Santa Claus rally window is the last four days of the year and the first two days of the new year, and it’s one of the seasonally bullish periods of the year. History shows that a failed Santa rally often leads to subpar returns for the remainder of the year. The first day of the window was December 24 and the last day was January 3.Santa has failed to call this year. The S&P 500 and the Dow closed above their respective Santa rally levels, though the Russell 2000 was marginally positive.

If adage about the Santa Claus rally is to be believed, the odds favour a subpar year in 2025 for the S&P 500: “If Santa should fail to call, the bears may come to Broad and Wall”.

Saturday, January 4, 2025

Trump's messy governing challenges

According to FactSet, the bottom-up aggregated S&P 500 target price for year-end 2025 is 6,678.18. But in the last 20 years, bottom-up analysts have historically overestimated the S&P 500 year-end price by 6.9%. Applying the 6.9% discount we would arrive at an adjusted target of 6,084.19, which represents a price gain of 5.7% for the year.

The FactSet adjusted estimate is roughly in line with my expectation of low single-digit gains. Along the way, however, I expect a higher degree of market volatility during the year as the Trump 2.0 Administration takes office and faces the challenges of governing.

Wednesday, January 1, 2025

So much for December seasonality

Instead, the stock market was weak in the second half of December and small caps leadership did not emerge during that period. That said, the S&P 500 ended to year right at trend line support and the NASDAQ 100 ended the year at 50 dma support.

Sunday, December 29, 2024

Contrarian bargains among Santa's discards

The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)*

- Trend Model signal: Neutral (Last changed from “bullish” on 15-Nov-2024)*

- Trading model: Bullish (Last changed from “neutral” on 19-Dec-2024)*

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent and on BlueSky at @humblestudent.bsky.social. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

If Santa should fail to call…

The Santa Claus rally window is the last four days of the year and the first two days of the new year, and it’s one of the seasonally bullish periods of the year. History shows that a failed Santa rally often leads to subpar returns for the remainder of the year. The first day of the window was December 24. So far, the market has performed well this year.There is an adage among traders: “If Santa should fail to call, the bears may come to Broad and Wall”. If the advance continues, the risk of a major bear market in 2025 is diminished though.

So far, the question of whether Santa Claus will appear this year is a toss-up. It is constructive that Friday’s S&P 500 decline bounced off the 50 dma. While the S&P 500 closed marginally below the December 23 close, which is the Santa Claus rally starting level, both the Dow and Russell 2000 closed above their respective Santa rally levels.

Saturday, December 28, 2024

Estimating downside risk

In other words, valuations don’t matter until they matter. As investors look ahead into 2025 against a backdrop of a high P/E market, one key question is: “What’s the downside risk in the event of a bear market?”

Sunday, December 22, 2024

The darker meaning of the HIndenburg Omen

The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)*

- Trend Model signal: Neutral (Last changed from “bullish” on 15-Nov-2024)*

- Trading model: Neutral (Last changed from “bullish” on 03-Dec-2024)*

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent and on BlueSky at @humblestudent.bsky.social. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

An unusual omen

I recently highlighted the trigger of the ominously named Hindenburg Omen, which describes the condition of a highly bifurcated market undergoing a downside break (see A Hindenburg Omen in an Oversold Market). While Hindenburg Omens often resolve in corrective market action, the current episode occurred against the backdrop of an extremely oversold market with readings reminiscent of the Christmas Eve Panic of 2018, the COVD Crash of 2020, and the October bottom of 2022.Saturday, December 21, 2024

Asset return expectations under an alien invasion

Is ET here?

While I am a subscriber to Occam’s Razor, which can be paraphrased as the simplest explanation is the most satisfactory, and these UFOs are of terrestrial origin, it’s a worthwhile exercise to consider asset return expectations under the scenario of an extra-terrestrial alien invasion.

Wednesday, December 18, 2024

A Hindenburg Omen in an oversold market

- The market has to be in an established uptrend;

- Market breadth becomes highly bifurcated, as measured by the expansion of new highs and new lows; and

- A downside break in price momentum.

Sunday, December 15, 2024

Could a hawkish rate cut rattle markets?

The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)*

- Trend Model signal: Neutral (Last changed from “bullish” on 15-Nov-2024)*

- Trading model: Neutral (Last changed from “bullish” on 03-Dec-2024)*

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent and on BlueSky at @humblestudent.bsky.social. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

Stubborn inflation

Saturday, December 14, 2024

The public embraces the Trump honeymoon

The latest University of Michigan sentiment survey is out, consumer sentiment surged in the wake of Trump’s victory.

The full post can be found here.

Wednesday, December 11, 2024

Here comes the end-of-year positioning season

Sunday, December 8, 2024

Bitcoin 100K: Buy or fade the animal spirits?

The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)*

- Trend Model signal: Neutral (Last changed from “bullish” on 15-Nov-2024)*

- Trading model: Bullish (Last changed from “neutral” on 15-Oct-2024)*

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent and on BlueSky at @humblestudent.bsky.social. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

Crypto leads the stampede

Now that Bitcoin has exceeded the psychologically important 100,000 mark, it is becoming evident that the FOMO risk-on stampede is in full force. The risk-on mood can also be seen in the relative performance of speculative growth stocks, as measured by the Ark Investment ETF (ARKK), which has shown a roughly correlation with Bitcoin. In addition, ARKK has staged an upside breakout from a multi-month base.

Is it too late for traders to hitch a ride on the risk-on train or should they fade the rally? Here are the bull and bear cases.

The full post can be found here.

Saturday, December 7, 2024

Investing during an era of American Exceptionalism

This was the year of TINA (There Is No Alternative) for American equities. Can it continue into 2025?

The full post can be found here.

Wednesday, December 4, 2024

Seasonal weakness ahead?

Sunday, December 1, 2024

Stock market clues from the bond market

The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)*

- Trend Model signal: Neutral (Last changed from “bullish” on 15-Nov-2024)*

- Trading model: Bullish (Last changed from “neutral” on 15-Oct-2024)*

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent and on BlueSky at @humblestudent.bsky.social. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

Clues from the bond market

The S&P 500 made a marginal all-time high last week and pulled back. However, investors may find insights about the near-term outlook for equities from the bond market.The accompanying chart shows how the VIX Index (middle panel, red dotted line, inverted scale) and MOVE Index (middle panel, black line, inverted scale), which is the VIX of the Treasury market, have mostly normalized their episode of pre-election anxiety. However, MOVE hasn’t fully normalized compared to VIX. We interpret this to mean that there is more room for Treasury yields to fall (bottom panel), which would be supportive of equity valuation.

Saturday, November 30, 2024

2025 outlook: Cautious but not bearish

This is the season when investment strategists publish their outlooks and forecasts for the coming year. This year, the message from investment banks is mostly the same: “We are bullish for stocks in 2025, but there are these policy risks of the new Trump Administration.”

This time last year, I expected returns of about 12% for the S&P 500, which is the average return during an election year. The S&P 500 has more than doubled that figure on a YTD basis. This year, I am expecting equity returns to be flat or in the low single-digits. I am cautious for 2025, but not bearish.

The main headwind facing stocks is valuation. The S&P 500 is trading at a forward P/E of 22, which is highly elevated by historical standards and ahead of the P/E valuation when Trump first took office in 2017. This doesn’t mean that the stock market can’t rise, but earnings growth will have to be the driver of price growth. Investors shouldn’t expect P/E expansion to boost stock prices. The combination of elevated valuation and no recession on the horizon that craters earnings expectations translates into a roughly flat stock market in 2025.

The full post can be found here.

Wednesday, November 27, 2024

All-time highs are bullish

Monday, November 25, 2024

An insightful interview with Scott Bessent

Sunday, November 24, 2024

All hail the bullish reversal

The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)*

- Trend Model signal: Bullish (Last changed from “neutral” on 11-Oct-2024)*

- Trading model: Bullish (Last changed from “neutral” on 15-Oct-2024)*

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent and on BlueSky at @humblestudent.bsky.social. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.